- Published on

Covered Lending Markets

- Authors

- Name

- Catalysis Network

- @0xcatalysis

Covered Lending Markets: Powered by Catalysis

TLDR

Covered Lending is a new credit product that pairs borrower collateral with a programmable coverage policy backed by restaked assets from networks such as EigenLayer and Symbiotic, creating a clearer loss-absorption structure for institutional credit.

Catalysis is deploying this model for institutional borrowers and underwriters that require clear, rules-based risk allocation.

It leverages Euler V2's modular vault architecture, which allows lending markets to define custom enforcement rules at the smart-contract level.Euler provides isolated vaults and hook integration points. Catalysis Coverage supplies the programmable risk-coverage logic that uses restaked collateral to back policy guarantees.

This opens a new path for structured credit markets to develop onchain.

Introduction

In traditional finance, unsecured credit powers trillions in global lending, from personal loans and credit cards to corporate lines of credit. In DeFi, similar concepts paused after the 2022 credit contagion, and the uncollateralised lending segment nearly disappeared. Today, it is re-emerging with new architecture, clearer operational structure, and programmable protection layers.

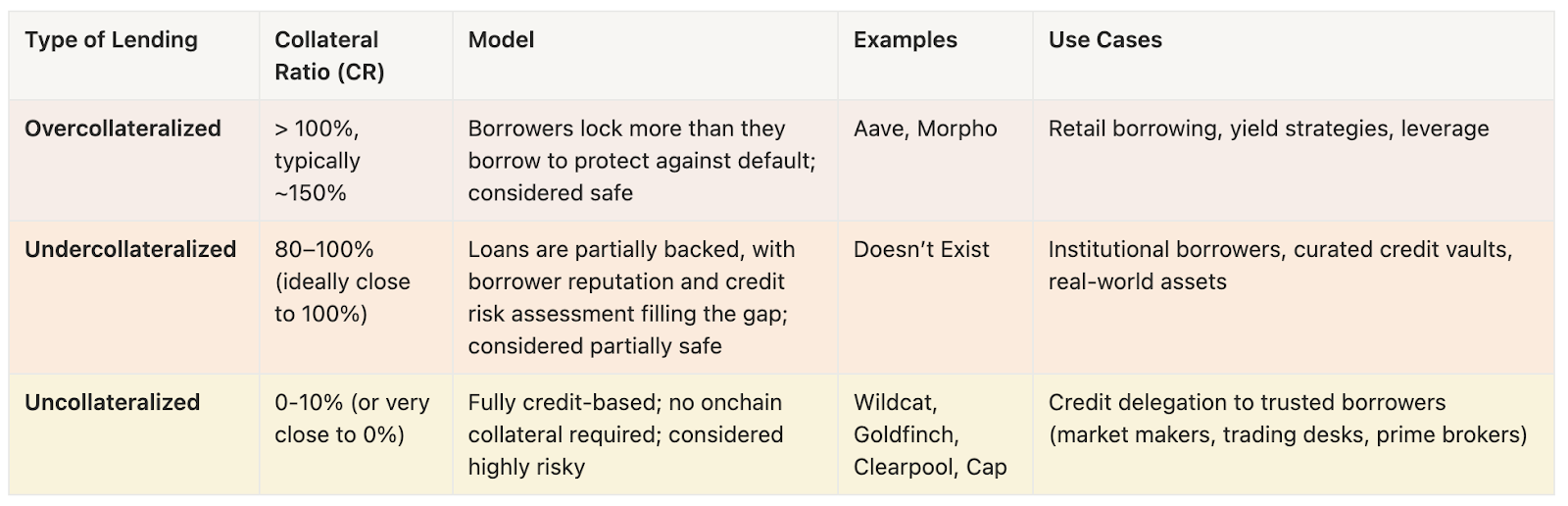

Overcollateralized lending became DeFi’s default risk management model. By requiring borrowers to post 120–150% of the loan value as collateral, protocols like Aave and Compound built liquidation-driven systems that could withstand volatility. When prices fall, collateral is sold instantly, keeping the system solvent.

This worked, but it came with a major trade-off. To borrow $100, users often lock up $150 or more. This ties up capital and limits real-world use, as a large portion of assets sit idle as backing.

But that inefficiency eventually pushed institutions and projects to explore alternatives like undercollateralized lending.

In contrast, undercollateralized lending mirrors the efficiency of traditional finance, where creditworthiness replaces collateral. It is faster, lighter, and more scalable, but also significantly riskier onchain.

The Untapped Opportunity

There is a clear gap in today’s markets. DeFi still struggles to combine the efficiency of undercollateralized lending with the security of traditional, collateral-backed systems. The risks are constantly evolving, and there is still a mismatch in accurately pricing these risks onchain, leaving much of the market’s potential untapped. The business case for solving this gap is enormous.

According to McKinsey, blockchain automation could save banks up to $1 billion a year in KYC compliance costs, reduce fines by $2–3 billion, and prevent between $7 and $9 billion in fraud-related losses. In 2023, a tokenised credit deal executed by BlockTower and Centrifuge demonstrated the potential of onchain workflows, reducing securitisation costs by over 90%, from roughly $400,000 to $40,000.

These figures highlight the efficiency gains possible when credit workflows move onchain. Before the sector can expand into broader credit markets, it will need to demonstrate that its core infrastructure can operate reliably through a range of market conditions. This includes having clear processes for volatility, isolated market design, and mechanisms that do not rely solely on overcollateralisation.

Even modest progress would be meaningful. Capturing just 10% of DeFi's existing $30 billion lending market would translate to about $3 billion in uncollateralised loans, roughly 20 times the combined active loan volume of Wildcat, Clearpool, and TrueFi. The global potential is far greater. The global unsecured business loans market reached approximately $5.0 trillion in 2024 and is expected to grow to about $5.55 trillion in 2025. This market is projected to reach $12.5 trillion by 2031. Capturing even 1% of that market by 2031 would represent $120 billion in volume, while 10% would exceed $1.2 trillion. For any protocol capable of supporting such a scale safely, the opportunity is transformative.

When the Current System Fails

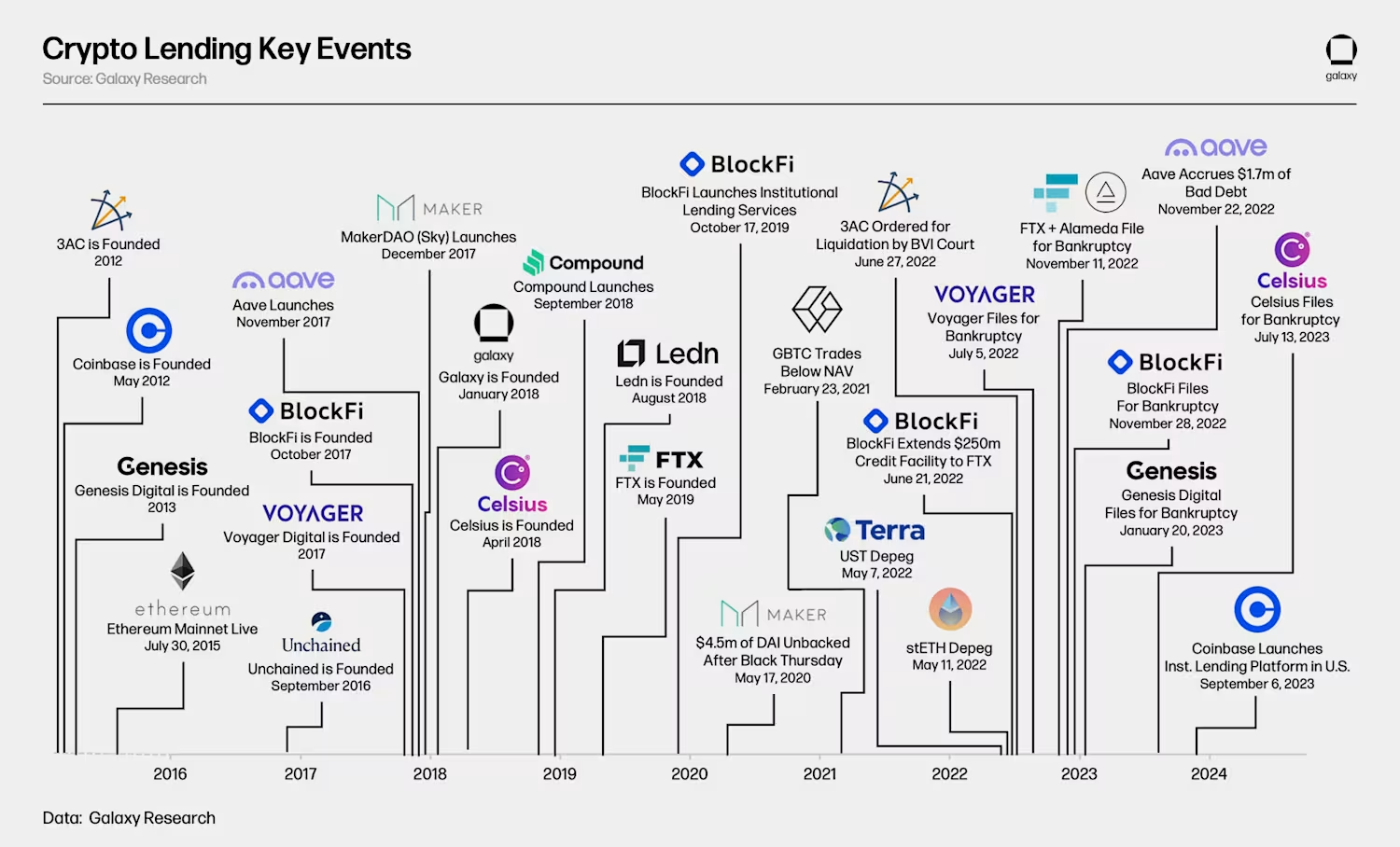

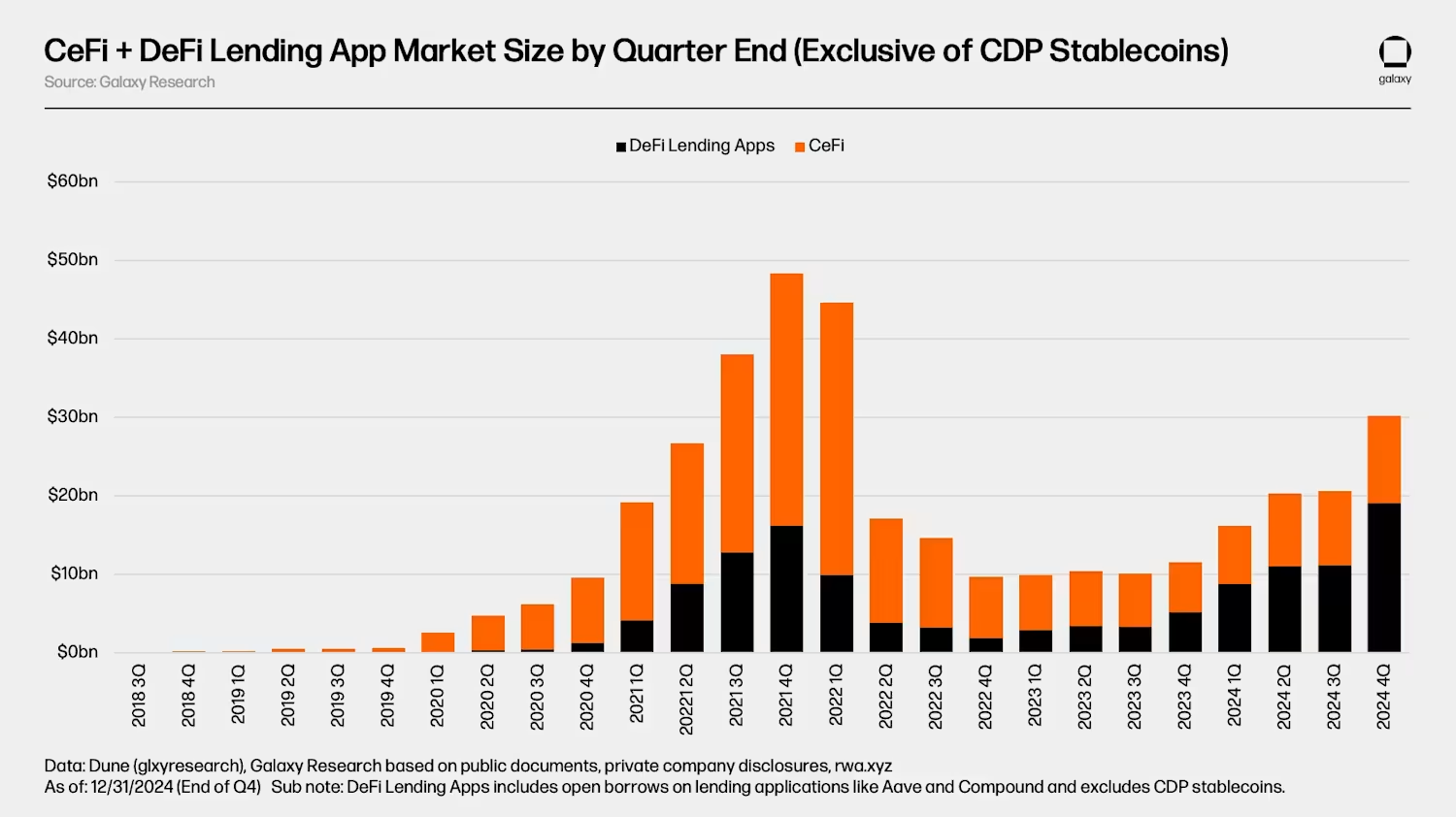

Uncollateralised lending was once seen as one of crypto's most promising frontiers. By early 2022, the CeFi credit stack had grown to over $35 billion across platforms such as Genesis, BlockFi, Celsius, and Voyager. Genesis alone managed a $14.6 billion loan book.

Source: Galaxy Research

But the foundation was flawed. These firms adopted the worst traits of both traditional finance and crypto without leveraging blockchain’s transparency. They recycled user deposits into loans for the same small set of counterparties, including hedge funds and institutional trading desks. User funds were rehypothecated, disclosures were limited, and loan books were opaque. When one major borrower defaulted, contagion spread instantly.

Genesis had $2.3 billion in loans to Three Arrows Capital, Voyager lent $935 million to 3AC, and BlockFi had $1.2 billion in exposure to FTX and Alameda. The resulting contagion was driven not by scale but by structure: concentrated counterparties, circular leverage, and a complete lack of real-time visibility into risk.

By late 2024, the total crypto lending market (including crypto-backed stablecoins) peaked at over $62 billion. Around 60% of that lending volume had shifted onchain into DeFi, while the rest remained in CeFi books. Galaxy Research data shows DeFi's share (black) expanding as CeFi (orange) continued to contract.

The top CeFi lenders such as Tether, Galaxy, and Ledn still held $9.9 billion in loans by Q4 2024, accounting for 27% of the total. However, the sector's composition changed dramatically after the collapse of BlockFi, Celsius, Voyager, and Genesis between 2022 and 2023. Together, these firms once made up nearly 40% of the entire lending market at their peak.

Even collateral backed lending can face challenges during periods of sharp volatility. These situations highlight the value of well defined liquidation processes, isolated market structures, and transparent operational parameters. As onchain credit evolves, these elements will play an important role in supporting reliable market behaviour.

So what went wrong in all these cases? The same root causes:

- No enforceable onchain penalties for negligence or fraud

- Opaque underwriting and limited borrower transparency

- Cross-pool contagion without proper isolation or monitoring

- Overreliance on reputation and goodwill instead of automated enforcement

When defaults occurred, lenders had no recourse. Liquidity evaporated, protocols reverted to overcollateralised models, and DeFi retreated from real credit exposure.

Over the past few years, several ambitious uncollateralised protocols such as TrueFi, Wildcat, and Centrifuge attempted to reimagine onchain credit. They brought institutional borrowers, real yield, and tokenised real-world assets to DeFi. For a time, the model worked. Yields were strong, activity surged, and the idea of “onchain credit markets” felt tangible again.

Then came a critical stress test.

In September 2025, Kinto, an L2 focused on compliant DeFi, announced an orderly wind-down after losses emerged in one of its unsecured credit markets. The loan in question totaled 750,000 USDC with a targeted 50 percent APR, a return profile that carried elevated risk. When performance deteriorated, lenders absorbed a 24 percent loss, roughly 180,000 dollars across 14 addresses, with most of the impact concentrated among a small group of participants.

And that's exactly the problem: DeFi credit continues to oscillate between two extremes:

- Overcollateralized markets (Aave, Morpho, Spark): about $30 billion in active loans, 3–5% APY, 120–150% collateralisation. Safe but inefficient.

- Undercollateralized markets (Wildcat, TrueFi, Clearpool): roughly $100 million in active loans, 7–15% APY, often under 10% collateralisation. Efficient but exposes lenders to more direct credit risk.

What's missing is the middle ground, a continuous, specialised risk infrastructure—the kind of real-time credit monitoring that traditional markets take for granted.

The lesson from this cycle is clear: uncollateralised lending doesn’t fail because of risk itself, but because of unpriced (or rather mispriced) risk. Without live monitoring, modular isolation, and enforceable coverage, risks accumulate until they explode. The encouraging news is that the new generation of protocols, infrastructure, and coverage systems is finally beginning to change that.

Catalysis Coverage: Training Wheels for Onchain Credit

Catalysis Coverage bridges the gap between efficiency and safety by acting as a programmable backstop for uncollateralised lending. Rather than eliminating risk, it redistributes it to the participants best equipped to manage it.

Through Covered Lending, Catalysis connects institutional borrowers with underwriters who stake restaked collateral as second-loss protection. If a borrower defaults, their collateral is liquidated first. Any remaining shortfall is then automatically covered by the Catalysis policy, which slashes the delegated restaked assets to fill the gap. This structure provides lenders with deterministic protection while giving borrowers access to capital at improved efficiency.

In simple terms, Catalysis introduces the training wheels for uncollateralised lending markets. It allows DeFi protocols such as Euler V2 to offer credit with lower collateral requirements while maintaining safety through programmable guardrails. These guardrails mimic traditional financial protections: instant enforcement, transparent pricing, and verifiable onchain payouts.

The goal is not to remove risk but to price it accurately. As onchain credit data matures, coverage parameters can become dynamic—premiums can adjust based on borrower performance, coverage ratios can evolve in real time, and curators can compete on underwriting quality. Over time, as lenders, curators, and restakers build a measurable track record, the market can gradually transition from covered lending to purely credit-based systems.

How Covered Lending Works

Covered Lending operates as a dual-sided marketplace that balances yield and protection.

- Depositors earn yield by supplying capital into Covered Lending Vaults on Euler. These vaults lend to institutional borrowers such as market makers, trading desks, and professional liquidity providers—the same players responsible for maintaining liquidity across crypto markets.

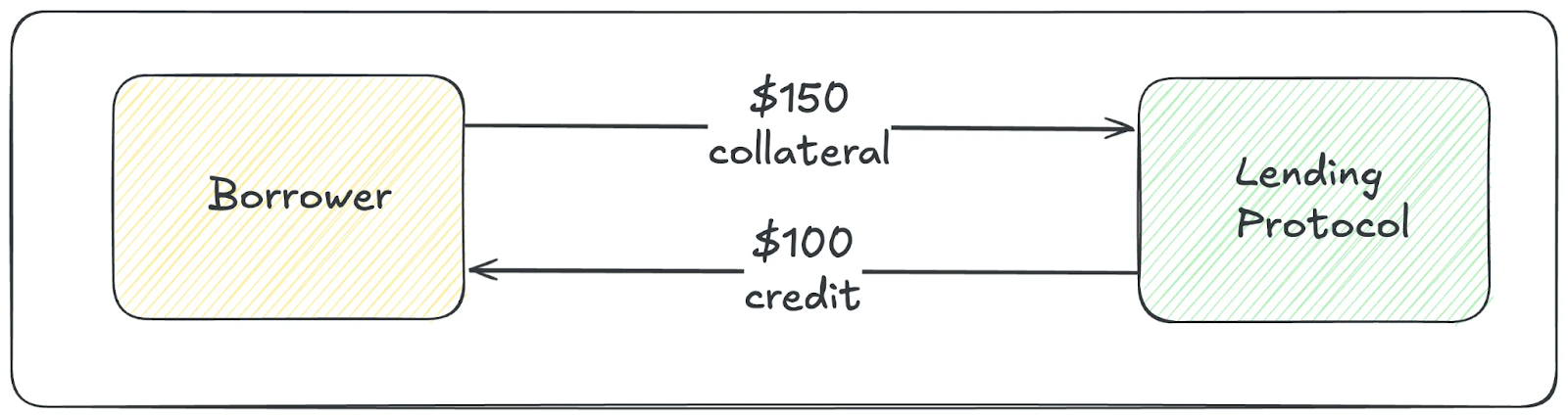

- Borrowers gain efficient access to credit. Instead of posting 150% collateral, they may post between 80% and 100%, with the remaining portion insured by a Catalysis coverage policy backed by restaked assets.

The core idea is simple: Use coverage to reduce collateral requirements without increasing risk for lenders.

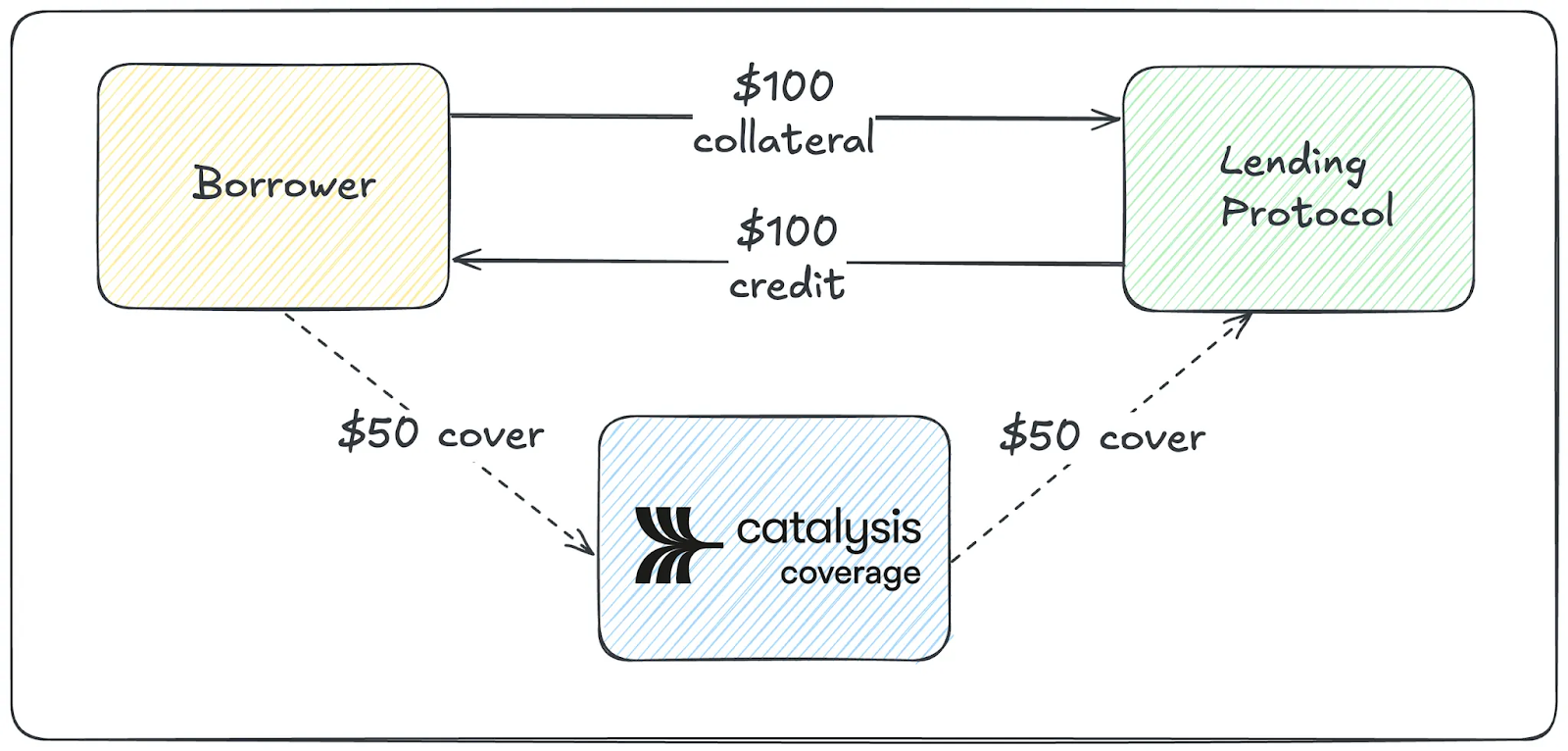

With Catalysis Coverage, borrowers can post less collateral and supplement it with coverage to unlock the same loan amount.

Here's what that actually looks like:

Instead of posting $150 to borrow $100, a borrower can post $100 in collateral and $50 in coverage to borrow the same $100.

This improves capital efficiency for borrowers while maintaining full protection for lenders.

In the event of a default:

- The borrower’s collateral is liquidated to repay lenders.

- If a shortfall remains, the Catalysis policy is triggered.

- Smart-contract-enforced payouts automatically slash the delegated restaked collateral, ensuring that depositors are made whole.

This model ensures that capital efficiency does not come at the cost of security. By combining risk coverage with real-time enforcement, Catalysis introduces a sustainable framework where uncollateralised lending can grow responsibly as markets mature.

Why Euler

Euler is one of the strongest and most innovative teams in DeFi. First launched in 2020, the protocol reached over $2 billion in total value locked at its peak before the recent market pullback.

Euler V2 marks a major evolution of the protocol. It has been redesigned from the ground up with modularity, security, and capital efficiency at its core. The new architecture is centered around the Euler Vault Kit (EVK), which allows anyone to deploy isolated, customizable lending and borrowing markets for virtually any ERC-20 token. This structure moves away from traditional monolithic pool models and enables precise control over risk and capital flows.

Euler’s Vault Kit (EVK) and Ethereum Vault Connector (EVC) framework make it uniquely suited for Covered Lending. These tools enable developers to deploy isolated vaults equipped with Hooks, customizable smart contracts that can intercept and enforce rules for any operation.

With Hooks, a Covered Lending vault can:

- Require borrowers to hold an active Catalysis policy token before borrowing.

- Validate Effective Collateral Ratios (ECR) that account for both collateral and coverage value.

- Automatically trigger claim settlements when liquidation shortfalls occur.

- Enforce utilization caps or pause guards based on real-time risk data.

This level of technical flexibility, combined with Euler’s strong audit record and security-first governance, makes it the natural foundation for building institutional-grade credit markets.

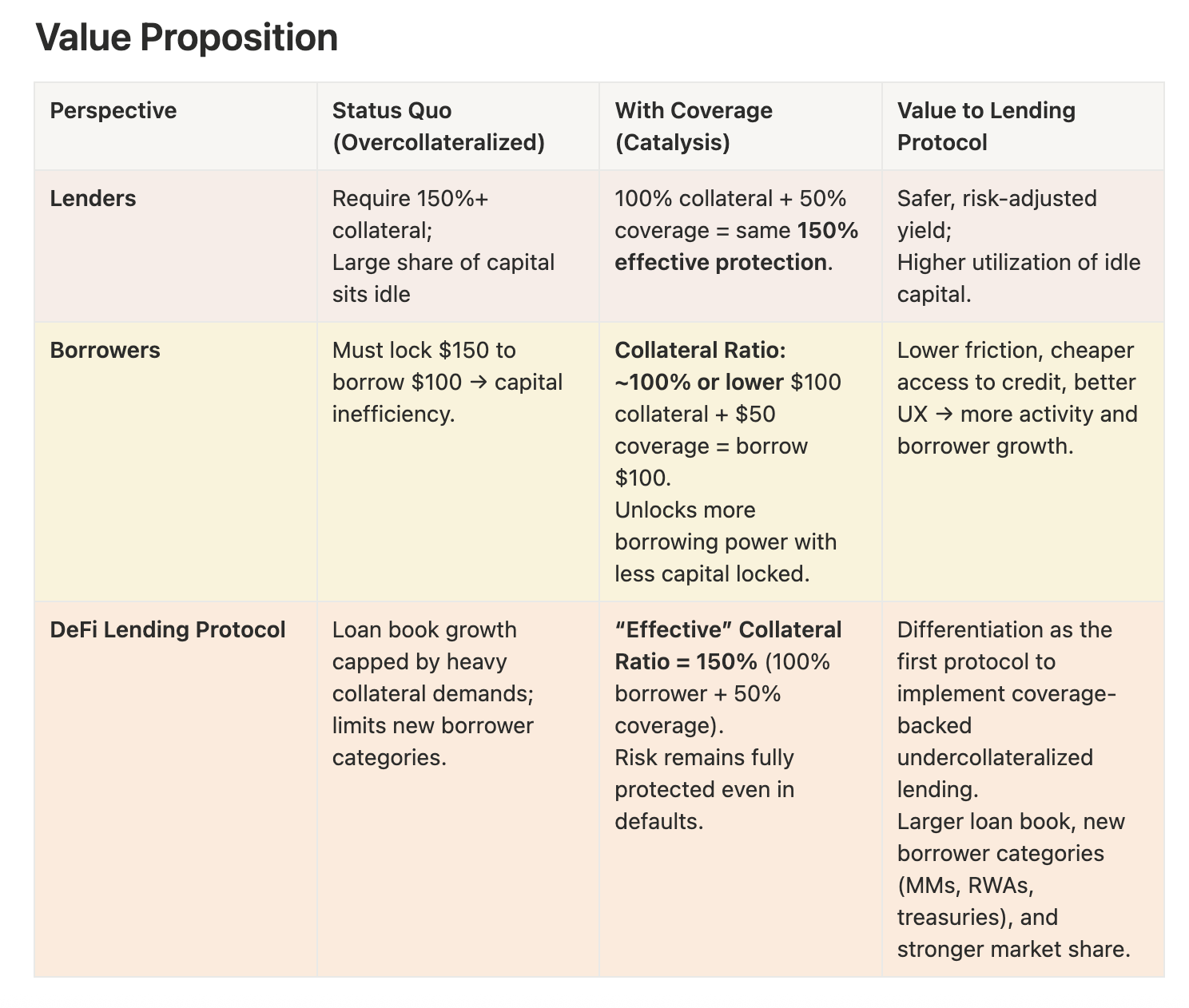

Bringing the Best of Both Worlds

Covered Lending combines the safety of overcollateralized lending with the efficiency of undercollateralized models while introducing a programmable protection layer designed for institutional scale.

- Institutional Due Diligence: Borrowers undergo professional credit assessment and continuous monitoring.

- Programmable Coverage: Deterministic, smart contract-based payouts replace governance votes and manual claim reviews.

- Diversified Exposure: Over time, coverage can extend to real-world credit and renewable energy infrastructure, offering uncorrelated returns.

- Second-Loss Protection: Restakers provide senior capital, absorbing losses only after borrower collateral is exhausted.

- Transparency: Every policy, borrower, and claim is fully programmable and visible onchain, eliminating black-box risk.

This model brings the best aspects of both DeFi and traditional finance into one framework—efficient, transparent, and institutionally resilient.

Looking Ahead

The first Covered Lending vaults are set to launch on Euler V2 in Q1 '2026 under a controlled pilot phase. Initial partners include institutional trading desks and crypto-native funds looking for scalable, coverage-backed access to onchain credit.

Following this launch, Catalysis plans to expand into real-world credit verticals such as private credit lines to leading business, trade routes, renewable energy infrastructure, and other regulated products. Each will be backed by programmable and verifiable protection, ensuring that both lenders and borrowers can operate with confidence.

Conclusion

Overcollateralized lending made DeFi safe. Covered Lending will make it efficient.

By combining Euler’s modular lending infrastructure with Catalysis’ programmable risk coverage, we are unlocking the next evolution of onchain credit, where capital and coverage operate through predefined rules and defaults are handled according to transparent mechanisms.

The future of DeFi credit is not overcollateralized or undercollateralized.

It is covered lending markets.