- Published on

Why DeFi Needs Institutional-Scale Coverage

- Authors

- Name

- Catalysis Network

- @0xcatalysis

Introduction

England solved this problem three centuries ago at Lloyd's Coffee House in London. A simple innovation turned speculative maritime ventures into predictable, investable opportunities, and sparked the explosion of global trade that followed.

Today, crypto faces the same exact challenge that once nearly destroyed international commerce.

The institutional capital that DeFi has long awaited is finally arriving. Institutional capital is ready to flow onchain, but they're waiting for something that barely exists in DeFi's current architecture: coverage.

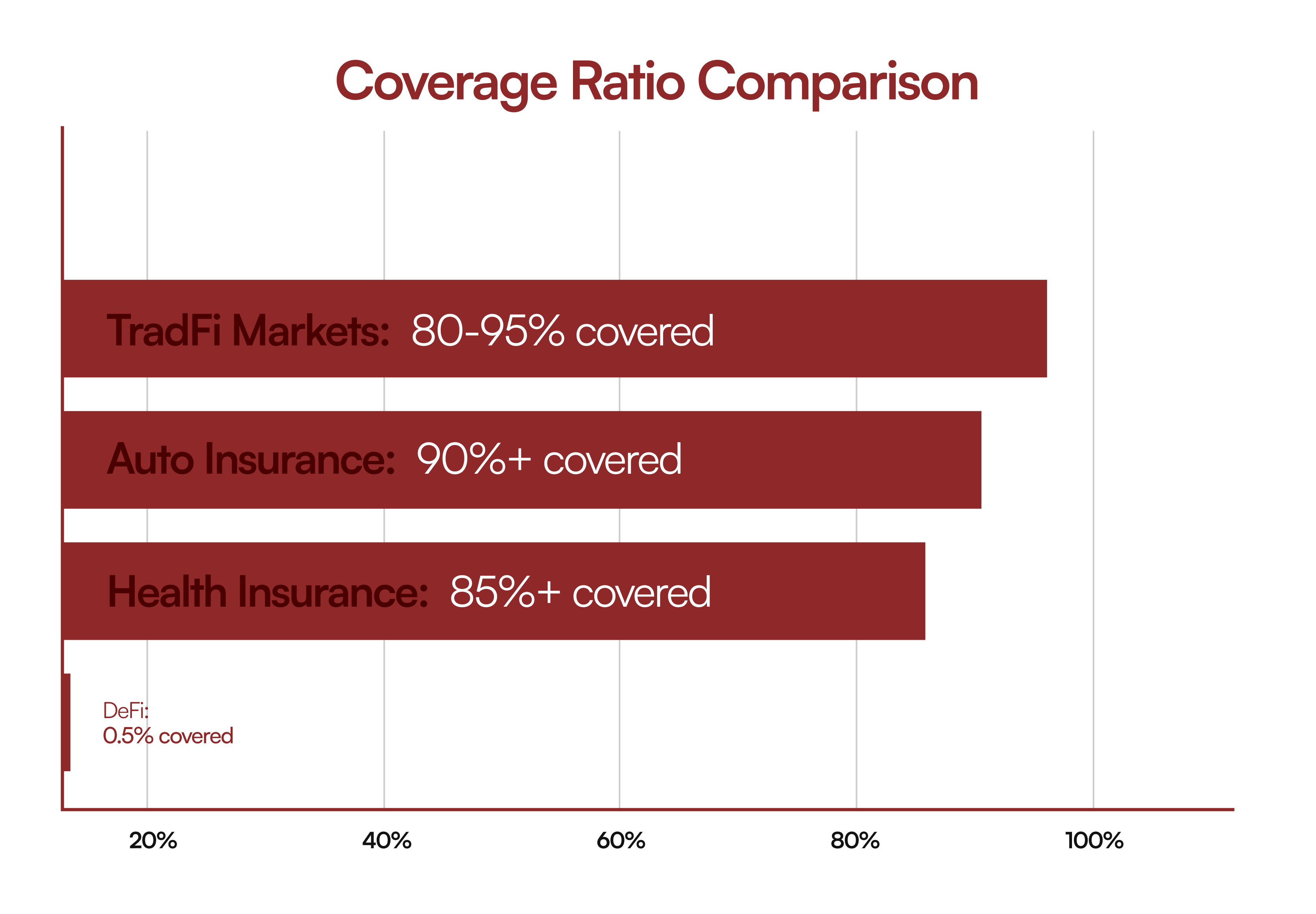

Only 0.5% of DeFi's total value locked is currently insured, compared to 80-95% coverage in traditional financial markets.

Left as is, this mismatch may end up becoming a trillion-dollar bottleneck.

The Great Onchain Migration has begun, but there's one critical piece of infrastructure that will determine whether institutional capital deploys onchain, or simply waits on the sidelines forever.

Institutional Capital is Finally Coming

We're witnessing what Pantera calls "The Great Onchain Migration": a tipping point where institutional assets are rapidly moving onchain at scale.

Over $30 billion in RWAs now exist on public blockchains, with major institutions like BlackRock, JPMorgan, and Siemens actively issuing onchain. According to Boston Consulting Group and Ripple, the tokenized asset market is projected to grow from $30 billion to $18.9 trillion by 2033.

In addition, the regulatory and political landscape has fundamentally shifted in crypto’s favour. The GENIUS Act, signed into law in July 2025, finally gave stablecoins a proper legal framework in the United States, demanding that every digital dollar be backed by a real dollar and establishing clear licensing processes. In Europe, MiCA regulations are now fully active, creating unified rules across the entire bloc.

Moreover, the election of President Trump in 2024 drove bullish market sentiments with expectations for greater regulatory clarity and crypto-friendly policies. And Singapore continues its crypto-friendly approach with Project Guardian, getting major banks into live sandboxes to test asset tokenisation.

This convergence of regulatory clarity and political support has unlocked genuine institutional interest in DeFi. 74% of institutions are seeking to engage in DeFi within two years, compared to just 24% currently active.

For the first time since crypto's inception, institutions have stopped simply watching from the sidelines, and are preparing themselves for active participation and capital deployment.

Bitcoin ETFs have already demonstrated institutional appetite, with global AUM reaching $179.5 billion by mid-2025.

Moreover, Visa, Mastercard, and JPMorgan Chase are building their own blockchain scaling efforts. Robinhood announced Robinhood Chain, and Stripe has partnered with Paradigm to build Tempo, both representing a new fintech playbook where platforms become the infrastructure itself and capturing fees previously paid to legacy financial intermediaries.

The numbers behind this migration are orders of magnitude larger than what crypto has ever seen in its history.

The DeFi market was valued at $13 billion in 2020 and is projected to reach $1.6 trillion by 2034. Of which, institutions and fintechs are projected to bring $500 billion to over $1 trillion in capital onchain.

Pantera predicts that tokenised equity volumes will reach $1 billion daily in two to four years, positioning blockchain as the default technology for capital formation and price discovery.

The Coverage Gap Dilemma

Despite the newfound institutional interest and the recent massive capital inflows into crypto, there's a fundamental mismatch that threatens to derail the entire onchain migration: the lack of insurance coverage for onchain funds.

Currently, only 0.5% of DeFi's TVL is insured. In contrast, traditional financial markets maintain 80-95% coverage, with other markets like auto and health insurance having even more coverage. So while DeFi has experienced 200% growth since 2020, coverage capacity has remained essentially stagnant.

As a result, deploying capital onchain is as risky as ever. $2.3 billion was lost in DeFi-related hacks in 2024 alone. Meanwhile, DeFi insurance protocols have paid out over $200 million in claims, only a fraction of what's been lost to exploits.

This coverage deficit becomes exponentially more problematic as institutional demand scales. When institutions talk about deploying hundreds of millions or billions onchain, they simply can’t do so safely without robust risk coverage infrastructure.

To understand why this bottleneck persists, we analyzed the current coverage solutions and their fundamental limitations in meeting institutional requirements.

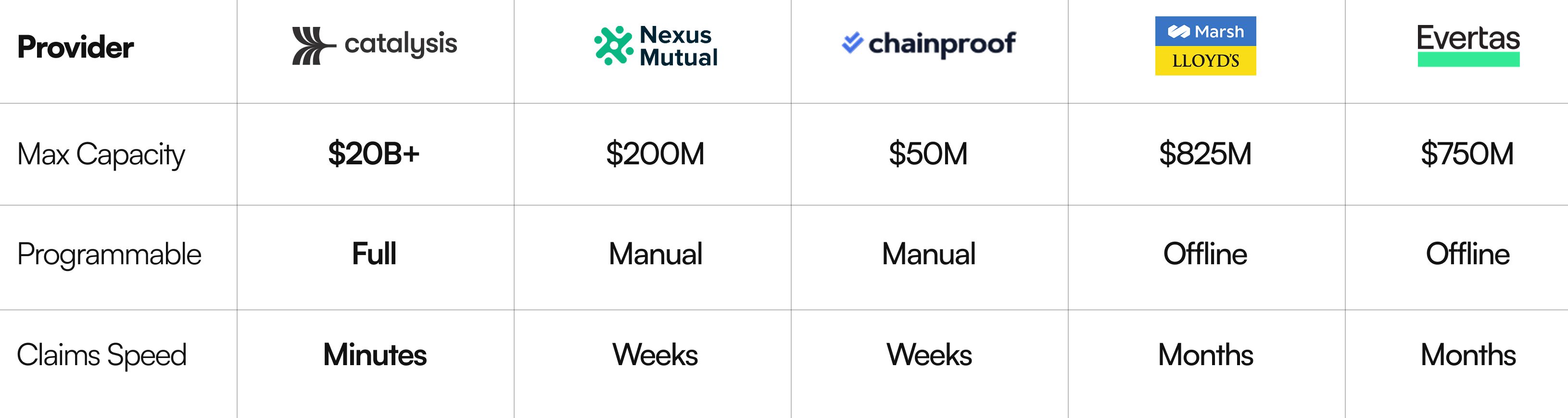

Of the current solutions, Nexus Mutual remains the most established player, with total value locked fluctuating between $167 million and $288 million and active coverage of approximately $194 million. While Nexus has successfully processed over $18 million in claims covering incidents like Rari Capital, Cream Finance, and Hodlnaut, its fundamental architecture creates barriers and hinders scaling coverage to work for institutional-grade numbers.

The protocol relies on manual claims assessment where community members vote on claim validity, with processing taking 36-72 hours minimum and often extending to weeks. For institutions requiring instant liquidity and deterministic outcomes, this governance model is incompatible with institutions’ fiduciary responsibilities. Nexus operates as a mutual insurance model, where capital pools are limited to what the community can bootstrap (currently around $200 million in active reserves).

InsurAce offers a multi-chain approach across Ethereum, Binance Smart Chain, and Polygon, but faces similar capacity constraints. The platform also relies on manual processes and limited capital pools. While InsurAce has expanded beyond Nexus's single-chain focus, its maximum coverage capacity remains well below what institutions require.

Traditional insurance companies like Lloyd's of London also offer crypto asset insurance, but their claims processing can take weeks or months, requiring extensive manual review and paperwork even for non-contested claims. The offline dependencies, expensive premiums, and conservative risk assessment models of traditional insurers make them incompatible with the speed and scale requirements of institutional DeFi.

In total, the entire DeFi insurance sector provides $1-2 billion in total coverage capacity, while relying on manual processes for their operations. When institutions discuss deploying hundreds of millions or billions in capital, they're talking about coverage requirements that exceed the entire existing market by orders of magnitude.

Another fundamental issue across all current solutions is that they were designed for retail DeFi users, not institutional capital deployment. Their capital sourcing mechanisms, governance models, claims processing systems, and compliance frameworks simply cannot scale to handle the hundreds of billions in coverage that institutional adoption requires.

As institutional capital flows increase by 10x or more over the coming years, this coverage gap will become the primary constraint on DeFi adoption. Big money simply cannot flow into markets without deterministic loss limits. Without addressing this infrastructure deficit, the Great Onchain Migration risks stalling before it reaches its full potential.

Solving the Gap with Catalysis

Our analysis of the current crypto coverage market highlights specific features that institutional-scale onchain coverage must possess.

- Massive scale capacity. Institutions need coverage in the hundreds of millions or billions per entity, requiring capital sourcing mechanisms that are 100x larger than current solutions and beyond what traditional bootstrapped liquidity pools can achieve.

- Programmable, onchain execution. Coverage must execute automatically through smart contracts within minutes rather than weeks, using transparent, algorithmically-determined pricing that adjusts to real-time risk conditions rather than subjective governance decisions.

- Legal enforceability and compliance. Coverage contracts need clear legal standing and built-in regulatory compliance at the protocol layer, including audit trails, regulatory reporting capabilities, and integration with institutional compliance systems.

- Transparent risk pricing. Dynamic pricing reflecting actual risk conditions enables institutions to model coverage costs into investment strategies, with real-time updates based on protocol health, market conditions, and broader risk factors.

- Configurable coverage terms. Institutions can tailor protection to specific risk profiles and regulatory requirements whilst maintaining efficient capital utilisation across diverse institutional needs and time horizons.

Luckily, the emergence of restaking infrastructure creates an opportunity to solve this gap between institutional DeFi demand and existing coverage solutions. Restaking protocols like EigenLayer, Symbiotic, and Babylon have assembled $20+ billion in capital specifically designed to secure novel applications. By leveraging the $20+ billion in restaked capital for coverage capacity, this will be the first time that crypto has had institutional-scale capital specifically allocated for risk underwriting.

Catalysis operates as a coverage marketplace that abstracts restaked capital from multiple protocols and chains, creating coverage capacity that can finally match institutional requirements.

This approach provides 100x the coverage capacity of existing solutions while maintaining the programmable, onchain characteristics that institutions demand. Through specialist risk curators launching dedicated CoverPools, Catalysis transforms idle restaked capital into active protection across onchain credit, vaults, stablecoins, and real-world assets.

With Catalysis, the technical architecture for an institutional-scale coverage marketplace now exists. Smart contracts automate claims processing within minutes rather than weeks, pricing adjusts dynamically to real-time risk conditions, and legal frameworks are built directly into the protocol layer. As a marketplace, Catalysis provides the execution layer that connects institutional demand with coverage providers and their available capital in a compliant, scalable manner.

The institutional adoption of DeFi represents one of the most significant opportunities in digital assets today. With $18.9 trillion in tokenized assets projected by 2033 and institutional capital flows accelerating globally, the infrastructure race is on. At Catalysis, we believe that a robust coverage marketplace is the final piece of infrastructure that enables institutional capital to participate onchain at scale.

The Great Onchain Migration is already underway. Major financial institutions are building blockchain infrastructure, regulatory frameworks are crystallizing, and trillions in traditional assets are preparing to move onchain.

The question isn't whether institutions will adopt blockchain technology, but whether they'll build on DeFi's open, programmable infrastructure or create closed, custodial, and traditional alternatives. The choice we make today determines whether DeFi fulfills its promise of democratizing finance at global scale.

To learn how institutional-scale coverage can enable your organisation's DeFi strategy, contact our team at catalysis.network

Socials: @0xcatalysis | Documentation