- Published on

Catalysis × SPICE

- Authors

- Name

- Catalysis Network

- @0xcatalysis

Catalysis × SPICE | Building Principal-Protected Credit for Institutional DeFi

Institutional DeFi and the Coverage Deficit

DeFi is entering its institutional phase - driven by stablecoins, RWAs, and onchain credit.

Trillions in offchain assets are preparing to move onchain, but the risk architecture behind them hasn't caught up.

While traditional markets operate with 80–95% coverage across deposits and credit, DeFi sits below 1%. This imbalance has become the primary bottleneck for institutional-scale capital deployment.

Existing coverage solutions remain slow, manual, and retail-focused - incompatible with institutional requirements for transparency, enforceability, and compliance.

Bridging this gap requires coverage and underwriting that are programmable, verifiable, and composable across both onchain and offchain capital layers.

That's the foundation of the Catalysis × SPICE partnership - to bring principal protection and enforceable coverage to institutional credit.

Inside SPICE: Institutional Credit and Risk Infrastructure

SPICE operates as a cross-border DeFi infrastructure layer connecting institutional yield, credit underwriting, and real-world asset (RWA) origination.

At its core, SPICE is a risk intelligence and execution platform - designed to bridge traditional credit structuring with onchain transparency. It brings together institutional borrowers, risk curators, and coverage providers under a unified, verifiable framework to create the first fully decentralised credit default swap and promote greater access to institutional capital.

SPICE’s system handles the entire lifecycle of institutional credit risk:

- Due diligence and risk evaluation of potential coverage clients.

- Risk parameterization, defining coverage scope, policy terms, exclusions, and triggers.

- Continuous monitoring and dynamic repricing, ensuring policies adjust in real time to underlying credit and market conditions.

- Reporting and escalation frameworks that deliver real-time insights and enforce accountability across participants.

By combining these functions, SPICE enables institutional-grade coverage origination and management for RWA credit, structured yield, and cross-border lending - turning complex, jurisdiction-bound financing into compliant, data-driven onchain assets.

Catalysis: Building the Coverage Layer for Institutional DeFi

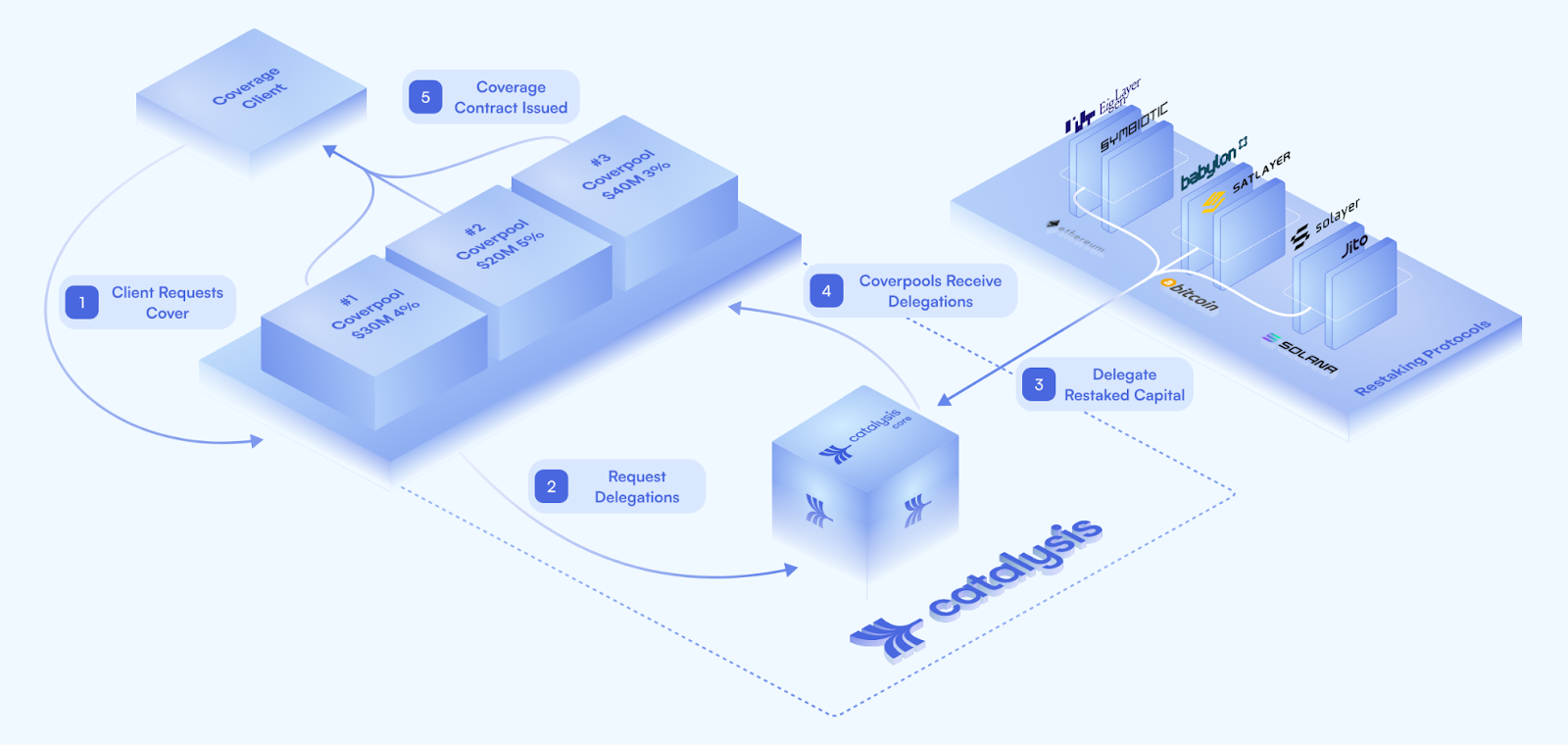

Catalysis Coverage provides the onchain infrastructure that powers programmable protection at institutional scale.

We transform restaked security into enforceable coverage capacity - enabling policies that quote, bind, and settle onchain within minutes.

When defaults or covered events occur, claims are executed automatically via collateral slashing and routed to policyholders - creating deterministic outcomes without governance delays.

By aggregating restaked capital from protocols like EigenLayer, Symbiotic, and Babylon, Catalysis supplies the underwriting depth needed to match institutional risk profiles.

In this model, Catalysis acts as the coverage marketplace for institutional DeFi, where capital, risk, and compliance intersect - and coverage becomes an infrastructure layer, not a product.

How the Partnership Works

The partnership between SPICE and Catalysis aligns traditional credit underwriting with programmable onchain coverage - connecting risk assessment, coverage capacity, and claims enforcement into one flow.

SPICE will use Catalysis’ coverage modules to underwrite institutional vaults, RWA credit, and stablecoin exposure, embedding coverage directly into credit and lending platforms.

Catalysis provides the infrastructure - CoverPools, policy issuance, automated claims, and restaked capacity for instant payouts.

SPICE brings the intelligence - credit research, borrower monitoring, dynamic repricing, and real-time risk scoring.

The process is fully onchain and transparent:

Risk input → Policy creation → Premium routing → Real-time monitoring → Claim automation.

When defaults occur, lenders receive instant payouts through Catalysis, while SPICE coordinates offchain recovery and redistribution to underwriters.

Over time, the system's borrower performance data feeds into a dynamic pricing engine - compressing premiums for verified, high-quality borrowers.

What This Collaboration Unlocks

This partnership establishes the missing layer for institutional onchain credit - combining principal protection, transparent underwriting, and enforceable recourse.

It unlocks:

Legible, institution-friendly unsecured lending: transforming under-collateralized loans into rated-like, trancheable assets that conservative capital can access.

A better match between DeFi liquidity and RW credit: instant onchain settlements with offchain enforcement managed by experts.

Scalable deal pipelines: curated property and trade finance from South Asia to South America, forming repeatable products - not one-offs.

Data-driven premium compression: as borrowers build history, coverage costs decline, improving market efficiency and velocity.

In effect, Catalysis × SPICE enables DeFi to evolve from open liquidity to open credit markets - compliant, covered, and ready for institutional scale.

Looking Ahead

SPICE and Catalysis share a single objective - to make institutional capital deployment onchain safer, compliant, and scalable.

Upcoming pilots across RWA credit, structured yield vaults, and coverage-backed lending will bring a new standard of assurance to DeFi’s credit layer.

Institutional capital isn't waiting for permission - it's waiting for risk coverage.

Together, Catalysis and SPICE are building it.