- Published on

Announcing Catalysis Coverage

- Authors

- Name

- Catalysis Network

- @0xcatalysis

The Missing Infrastructure for Institutional DeFi

Press Release: For additional coverage and industry perspective on this announcement, read our official press release: Catalysis Announces Pivot to Institutional DeFi Coverage.

Introduction

Today marks the biggest moment in our company's history.

After months of customer conversations and deep market analysis, we've made a fundamental strategic shift that will define the next chapter of institutional DeFi adoption. We're announcing the next chapter of Catalysis as the first fully onchain risk coverage infrastructure purpose-built for institutional scale.

Why We Pivoted: The Trillion-Dollar Problem

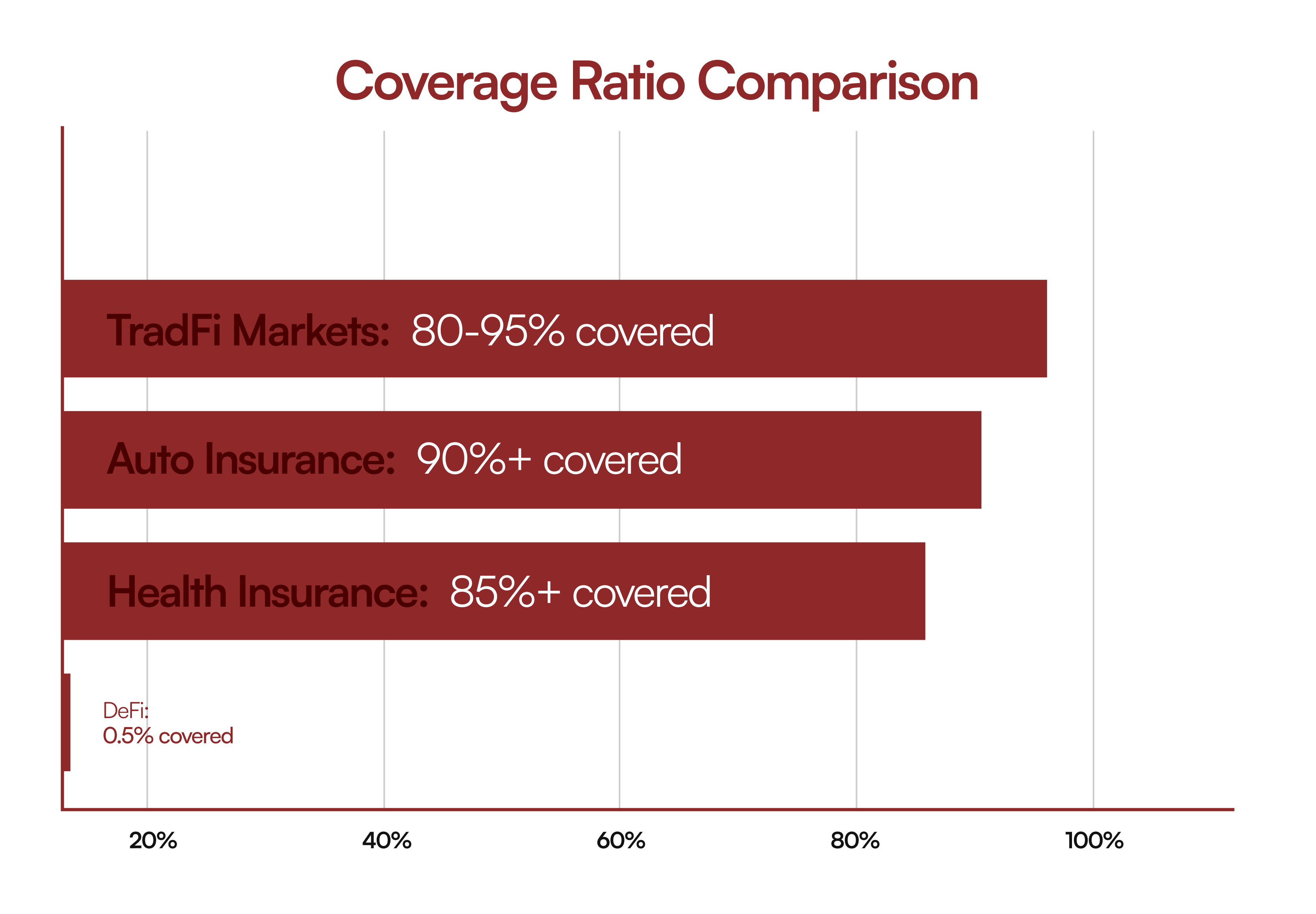

When regulatory clarity finally arrived for digital assets, we expected institutional capital to rapidly flood into DeFi protocols. Instead, we discovered something shocking: only 0.5% of DeFi TVL is currently insured.

The reason became clear through conversations with many potential institutional clients. While institutions are ready to bring trillions onchain, they’re still waiting on the sidelines because they face a critical infrastructure gap. The risk to move capital onchain is simply still too high because of the lack of deterministic loss limits in the industry. Most DeFi coverage protocols can only protect a few million dollars, which is nowhere near the hundreds of millions or billions that institutions require for policies.

We discovered that this is a fundamental problem with the architectural design of current coverage protocols. Current coverage solutions have:

- Processes and experiences designed for retail customers, not institutions

- Offchain processes that slow down client applications and approvals

- Manual claims disbursements that create counterparty risk

- Bootstrapped liquidity pools that can't scale beyond limited capacity

As a result, institutions with massive capital allocations are hesitant to deploy capital onchain, instead waiting for coverage infrastructure that matches their scale and compliance requirements.

The Solution: Redesigning Coverage from Scratch

Catalysis is now a programmable risk coverage protocol, purpose-built for institutions. It transforms $20B+ in restaked capital into active protection across onchain credit, vaults, stablecoins, structured yield products & real-world risks.

The Catalysis approach fundamentally reimagines how risk coverage works in DeFi through a fully onchain architecture that delivers programmable payouts through smart contracts, transparent and dynamic pricing that adjusts to real-time risk conditions, automated claims disbursement with no manual intervention, and institutional compliance built directly into the protocol layer.

In addition, our CoverPool architecture enables specialist risk curators to launch dedicated coverage vaults that draw capacity from the restaked capital abstraction layer. Each CoverPool can issue multiple policies tailored to different institutional verticals and risk profiles, creating a professional risk management layer that meets institutional standards while maintaining the programmable benefits of onchain execution.

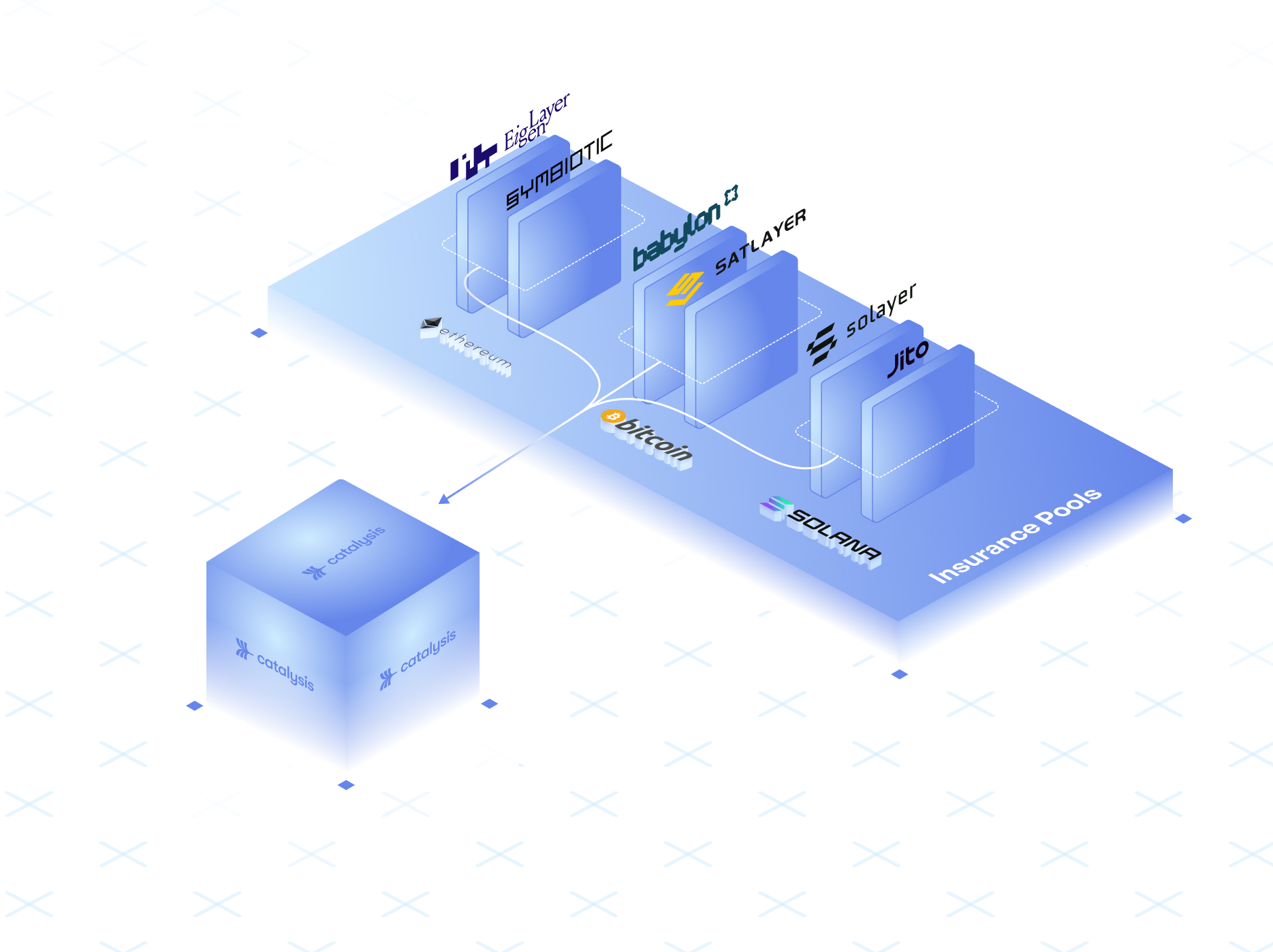

Instead of being constrained by sourcing pools of liquidity from scratch, Catalysis leverages restaked capital from leading protocols including EigenLayer, Symbiotic, and Babylon. By abstracting away the complexities of underlying restaking protocols, this approach provides over a combined $20 billion of coverage capacity, which is 100x the coverage capacity of existing solutions. This fundamentally solves the scale limitations of current coverage solutions that have prevented institutional adoption.

Why Wasn't This Possible Until Now?

Traditional coverage solutions face fundamental architectural limitations that prevent institutional-scale deployment. Nexus Mutual and other existing protocols rely on manual claims assessment where community members vote on claim validity, with the process taking 36-72 hours minimum and often extending to weeks. Traditional insurance claims processing can take weeks or months to complete, with even non-contested claims requiring extensive manual review and paperwork.

These protocols are also constrained by limited capital pools. Nexus Mutual currently operates with approximately $200 million in active reserves, while competitors like Chainproof and others max out at $800 million in capacity. For institutions requiring hundreds of millions or billions in coverage, these solutions simply cannot scale.

Institutional-scale coverage is only possible because we built Catalysis Core as the first Security Abstraction Layer, providing developers a single interface to access ETH, BTC, and SOL-backed economic security across all major restaking protocols. This unified infrastructure aggregates $20B+ in restaked capital from EigenLayer, Symbiotic, Babylon, and others into programmable coverage capacity.

Catalysis Core architecture

Catalysis Core architectureHow Catalysis Coverage Works

Catalysis connects three moving parts into a single flow that transforms idle restaked capital into active yield generated from institutional demand.

Restakers are the starting point. They deposit digital assets like ETH, BTC, SOL and other blue-chip assets into restaking protocols like EigenLayer, Symbiotic and Babylon. Catalysis Core aggregates that capital, and the pooled collateral then forms the raw "capacity" for underwriting risk. This abstraction layer is what enables us to reach $20B+ in protection capacity.

Next, specialist risk curators launch dedicated coverage vaults called CoverPools. These pools draw capacity from Catalysis Core and are designed to underwrite specific types of risk. Each CoverPool can issue multiple policies, tailored to different verticals or institutional needs. For example, one CoverPool might specialise in covered lending markets while another focuses on stablecoin protection or vault liquidity coverage.

Once restakers delegate capacity to a CoverPool, that pool can issue onchain policies to reputable institutional clients such as trading desks, market makers, and prime brokerage firms. These policies are fully programmable smart contracts with transparent terms, automated execution, and instant claims processing.

Premiums from institutions flow into the CoverPool and are automatically distributed back to restakers. This creates a direct economic incentive for capital providers while ensuring that coverage remains competitively priced. In the event of a claim, restaked capital is slashed via Catalysis Core and used to cover losses, with payouts executed automatically through smart contracts within minutes rather than weeks or months.

In summary, institutional clients get the coverage capacity they need, CoverPool curators earn fees for professional risk management, and restakers receive sustainable yield on their capital.

Catalysis Coverage Architecture

Catalysis Coverage ArchitectureUnlocking Institutional Use-Cases

Catalysis Coverage enables entirely new institutional applications at scale. Here are three examples of what becomes possible:

Covered Lending Markets address the fundamental capital inefficiency in traditional DeFi lending, where borrowers must often lock up significantly more capital than the loan amount (ex: $150 or more to borrow $100), which creates enormous waste of capital resources. With Catalysis Coverage, borrowers can supplement collateral with coverage, dramatically improving capital efficiency by directly replacing idle collateral with protection. Instead of requiring $150 in collateral for a $100 loan, borrowers can post $100 in collateral plus $50 in coverage to achieve the same borrowing capacity. This model maintains protocol security while enabling more borrowing power with less capital locked, lower friction access to credit for institutions, and scalable lending that extends beyond current collateral-heavy limitations.

Covered Stablecoins solve critical vulnerabilities that plague existing yield-bearing stablecoin protocols, including borrower defaults and coverage shortfalls that can trigger depeg events and significant losses for token holders. Catalysis provides onchain protection that automatically covers losses when borrowers default and maintains the stablecoin's 1:1 peg even during market stress, creating institutional-grade stability while enabling protocols to offer competitive yields that attract institutional capital.

Coverage for Vault Infrastructure addresses the fundamental liquidity mismatch that constrains DeFi vault growth, where protocols lend deposited funds for fixed periods of 30-90 days but must honour instant withdrawal requests from depositors. During withdrawal surges, vaults are forced to either liquidate loans early at significant losses or implement redemption queues that damage user trust and adoption. Catalysis provides instant, on-demand liquidity during withdrawal spikes, functioning like a credit line that gets repaid as underlying loans naturally mature, thereby eliminating the traditional trade-off between capital efficiency and user flexibility.

Conclusion

Our roadmap to institutional-scale coverage begins with a closed testnet pilot in Q4 2025, where we'll launch pilot CoverPools with flagship institutions to showcase the full coverage lifecycle in a controlled environment. This will transition to a pre-mainnet launch in Q1 2026, deploying on Ethereum mainnet with whitelisted curators and policy buyers under controlled coverage capacity to ensure stability and compliance. By Q2 2026, we'll scale to full mainnet launch, expanding capacity and onboarding the next wave of curators and institutional partners.

We believe that coverage is the missing infrastructure that institutional capital markets need to operate onchain at scale. Programmable coverage offers the transparency and automated efficiency for traditional finance to safely move onchain. Much like how deposit insurance restored trust in banking during the Great Depression, institutional-scale coverage can restore trust in DeFi.

By solving the coverage bottleneck that has constrained institutional adoption, we're enabling trillions in institutional capital to deploy onchain with confidence, unlocking new financial products that combine DeFi innovation with institutional-grade protection, and creating scalable risk management systems that grow with the market rather than constraining it. As more capital joins the Catalysis ecosystem, coverage becomes even stronger, drawing more institutions and creating a flywheel effect.

The timing couldn't be better. The institutions are showing genuine interest, the capital is waiting to be deployed, DeFi has reached institutional-grade maturity, and the regulatory clarity has arrived. The only missing piece was infrastructure that could handle their scale and compliance requirements. That infrastructure is Catalysis.

Get Involved

Catalysis represents an open coverage ecosystem where developers, curators, and researchers can participate in building the future of onchain capital markets.

For institutions: If you're an institutional borrower, restaking protocol, LRT, or DeFi protocol looking for institutional-scale coverage, our sales team is ready to discuss how Catalysis can support your growth.

For Developers: While Catalysis Coverage is not yet open-source, teams interested in early access can reach out directly to our business team.

Stay Connected: Follow our journey and get the latest updates on our progress toward institutional-scale DeFi.

Contact: yanshu@catalysis.network | Telegram: @xyanshu

Socials: @0xcatalysis | Documentation